Lymko

Container

Park

Container Homes Austin, Texas

20 Detached Containers North Austin, TX

We propose developing 20 modern container homes in a high-demand rental market by leveraging a strategic partnership with Bob’s Containers for swift delivery.

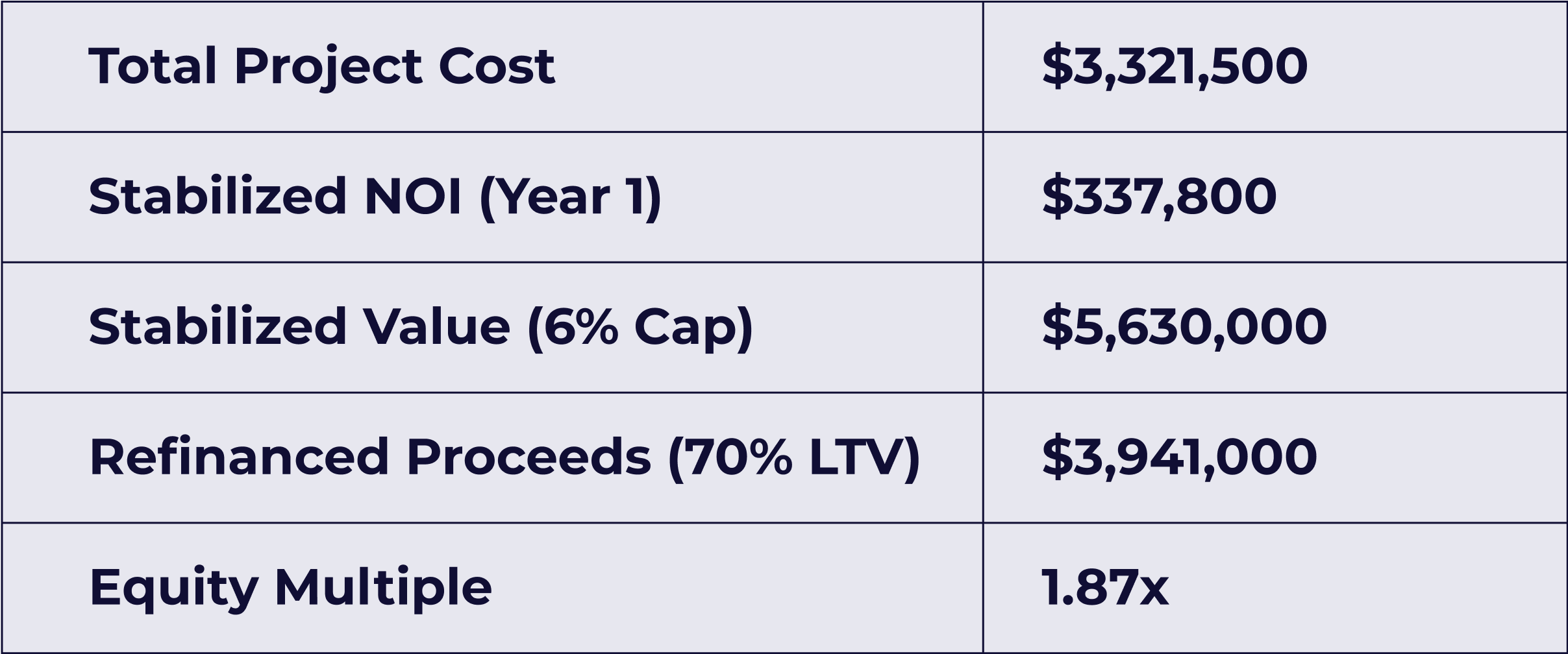

Our strategy is to expedite construction and subsequently secure refinancing with a traditional long-term loan, underpinned by a stabilized valuation of $5.4 million and Month 24 expected DSCR of 1.32.

Executive Summary

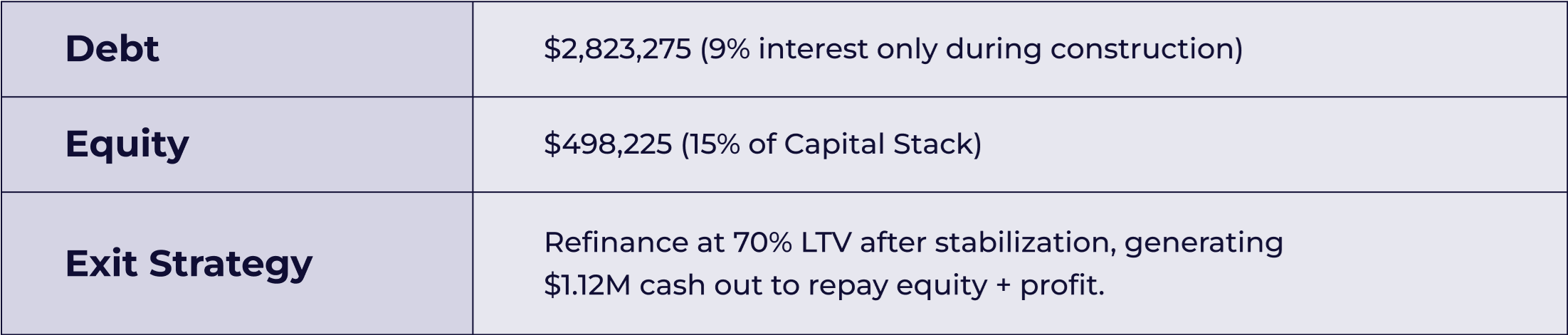

We are developing 20 modern container homes in Austin for mid-tier rentals, with a $3.32M total cost and a $5.6M stabilized value (6% cap rate). Low equity ($498K, 15%) and high leverage ($2.8M, 85%) to maximize investor returns.

Cost Efficiency & Fast Delivery

Land acquisition ($1.1M, 33%) and Bob’s Containers’ fixed pricing ensure cost certainty. Prefabricated units bypass city permits, enabling 4-month delivery and minimizing delays.

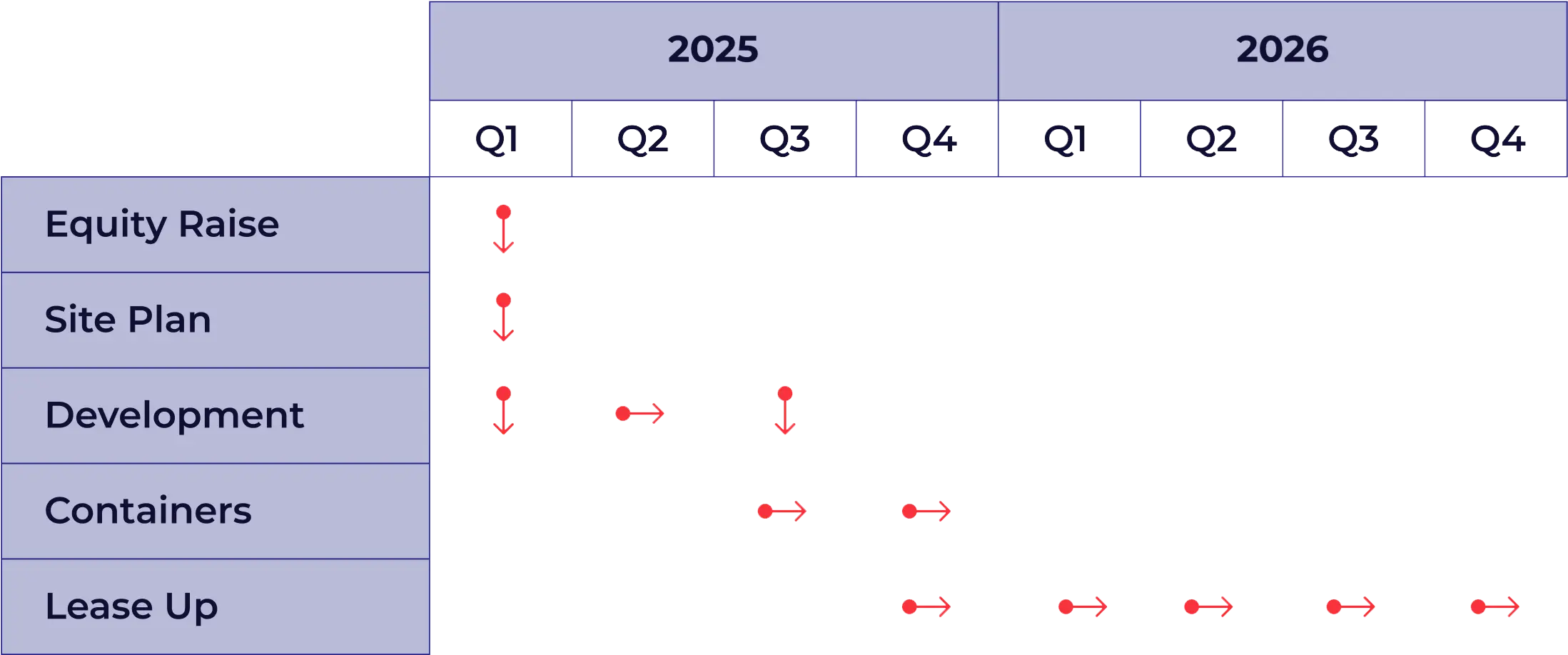

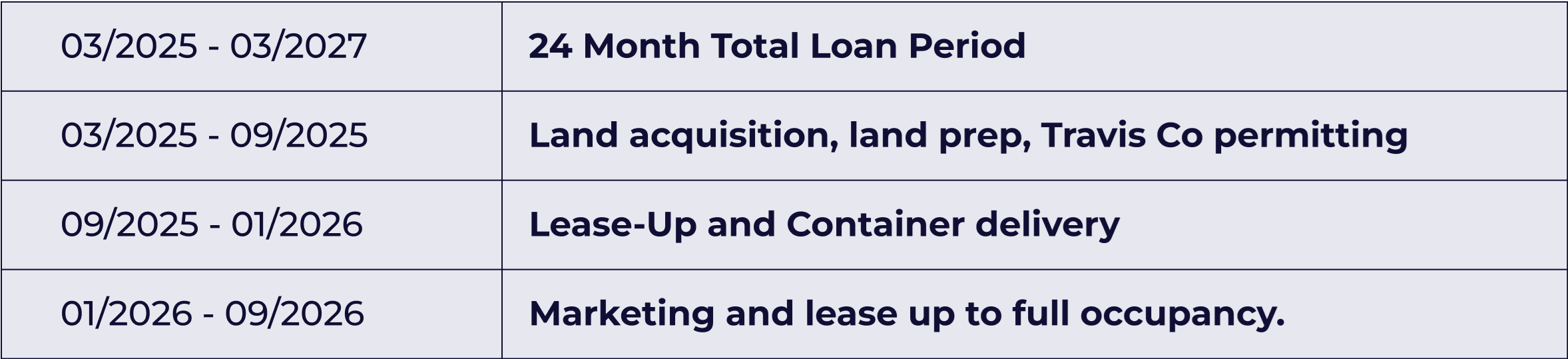

Accelerated Development Timeline

Travis County permitting and off-site fabrication compress development to 12-16 months, with lease-up by 09/2026. Aggressive pre-leasing reduces vacancy risk.

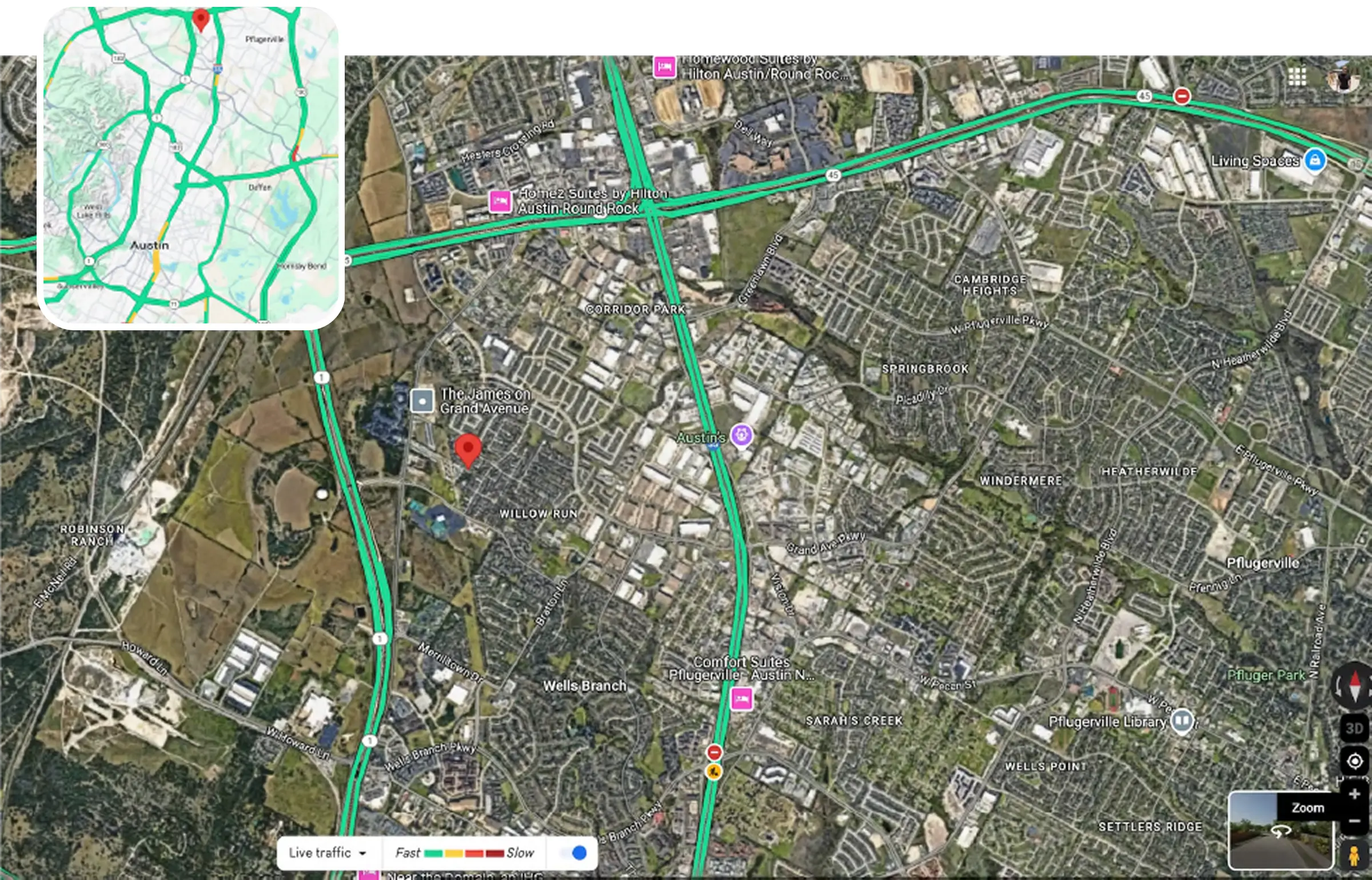

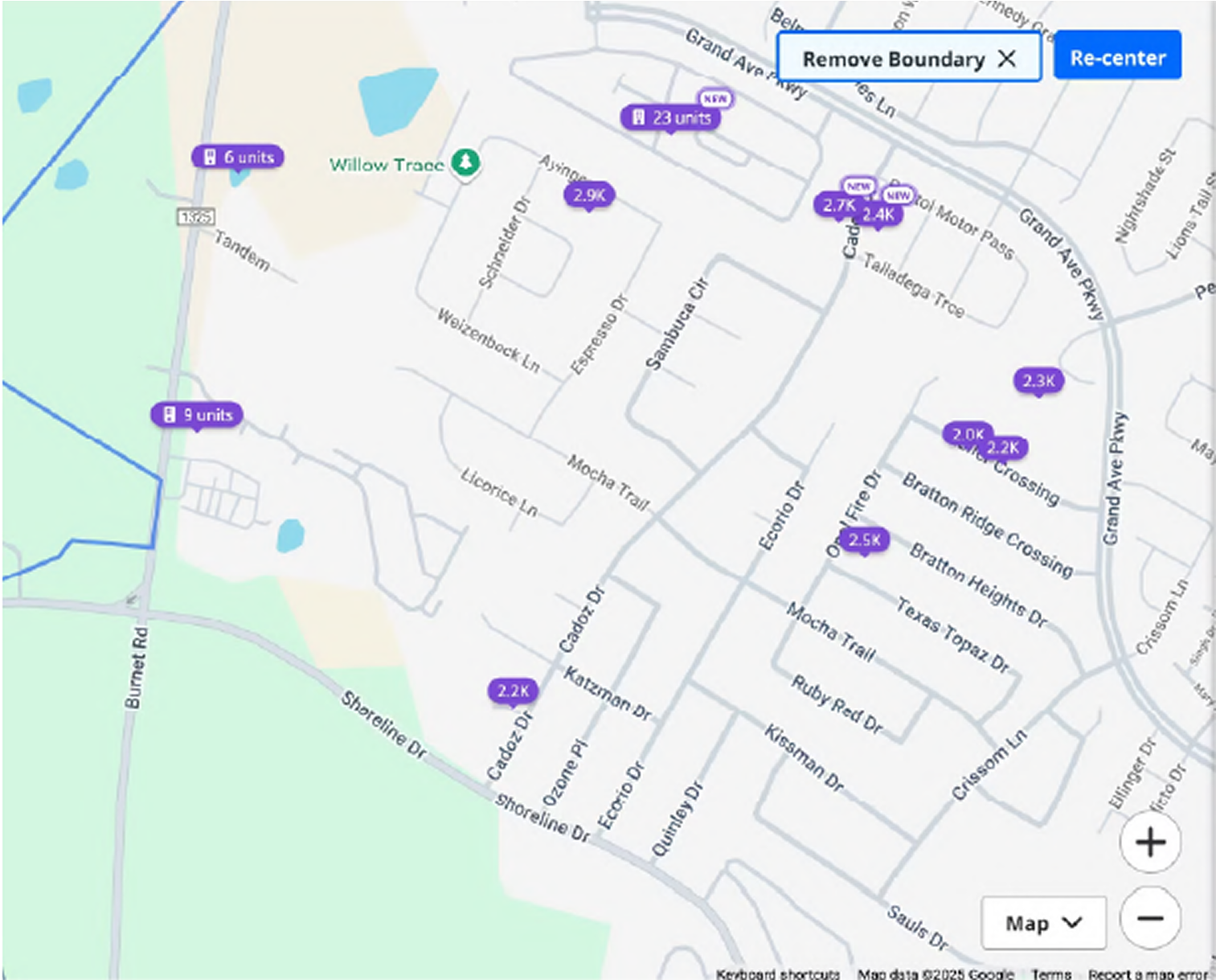

Prime Location & Strong Demand

Located in a high-growth rental market, offering $1,800/month rents (20% below city avg.). Close to I-35 & toll roads, with strong demographics and limited mid-tier supply supporting stability.

Conservative Financial Model

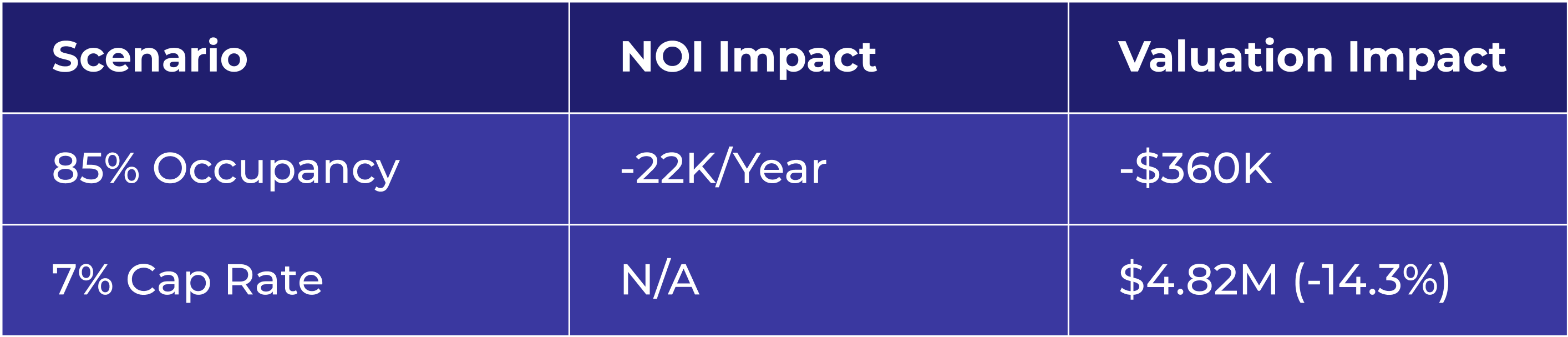

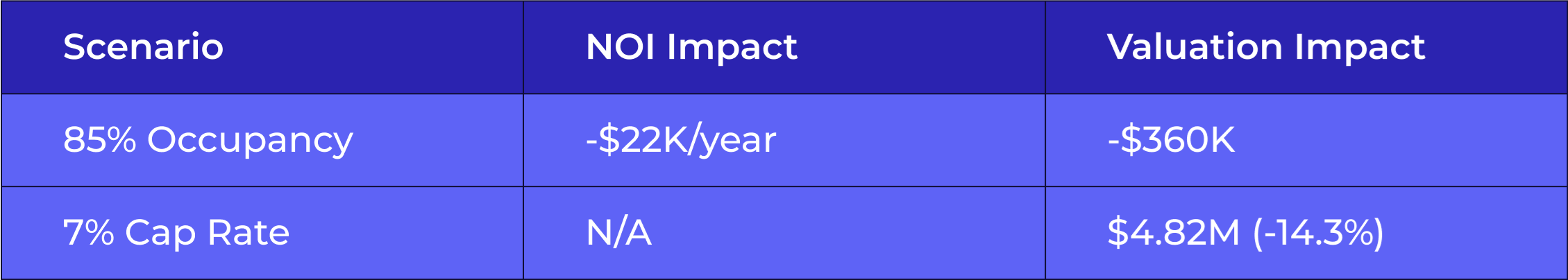

Assumes 90% occupancy ($337K NOI) despite Austin’s 95% multifamily avg. 20% below-market rents provide downside protection. Even at 85% occupancy, the project maintains a 1.20x DSCR and $5.63M valuation (7% cap rate).

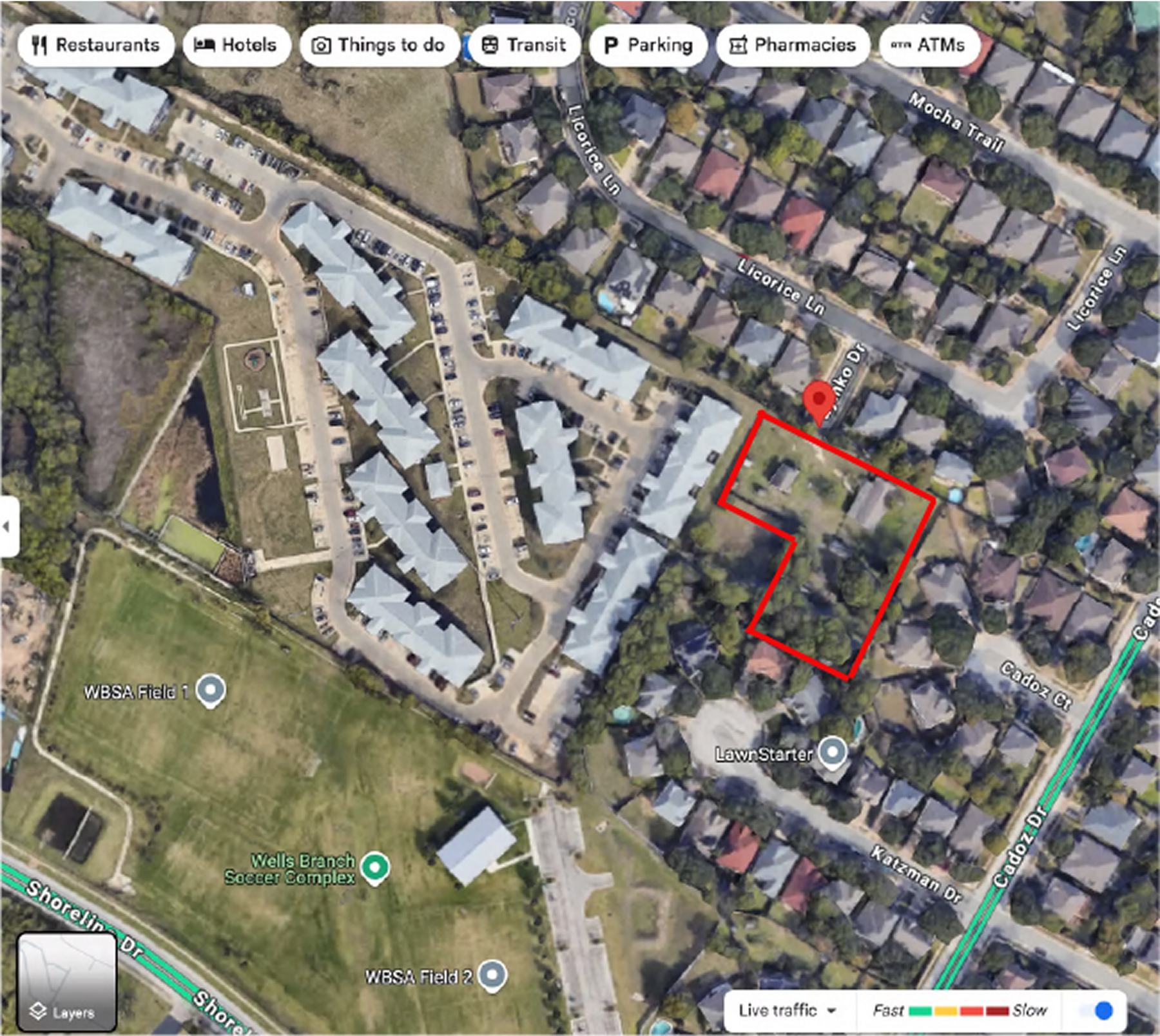

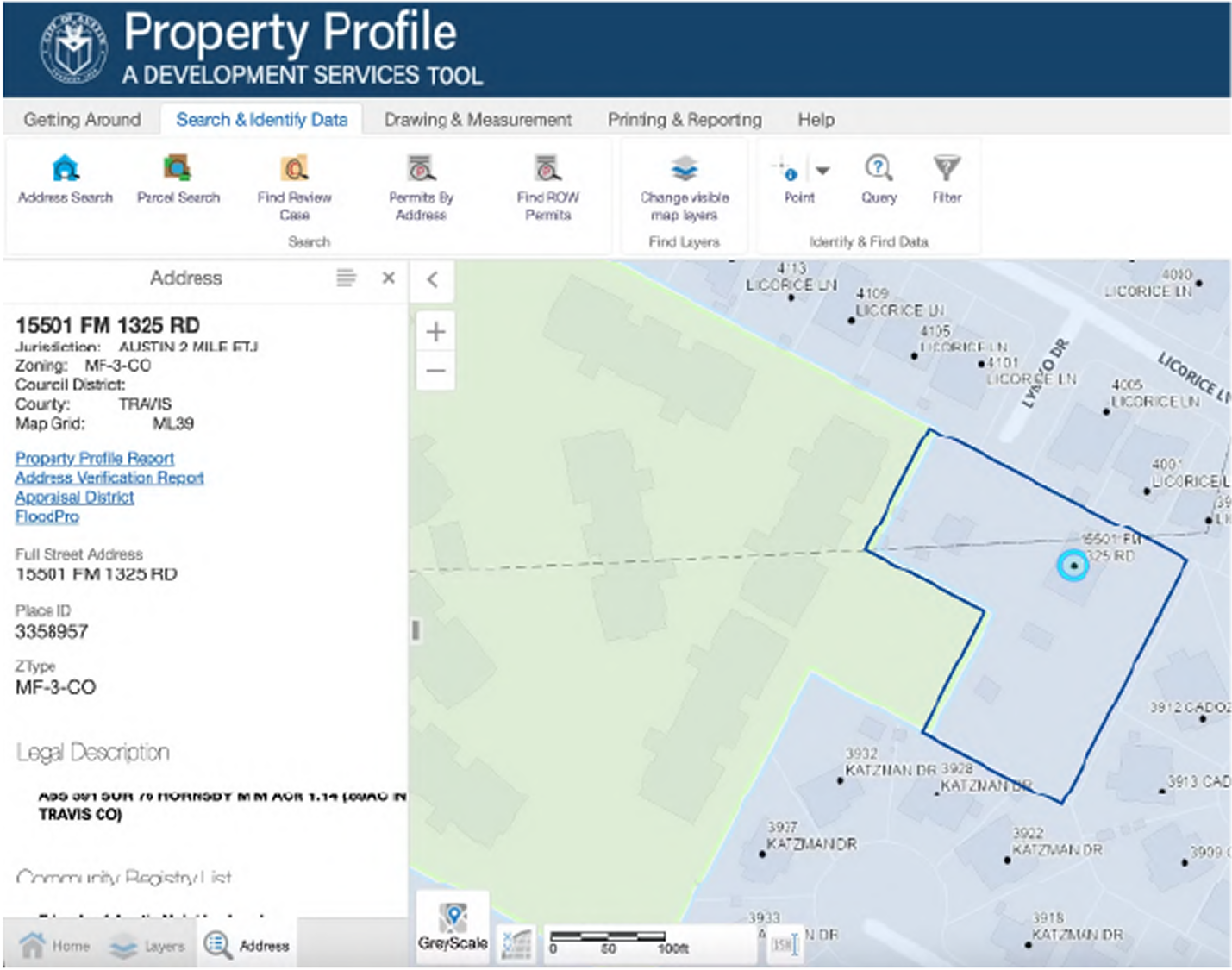

Location

15500 Lymko Dr,

Austin, TX 78728

Parcel Detail

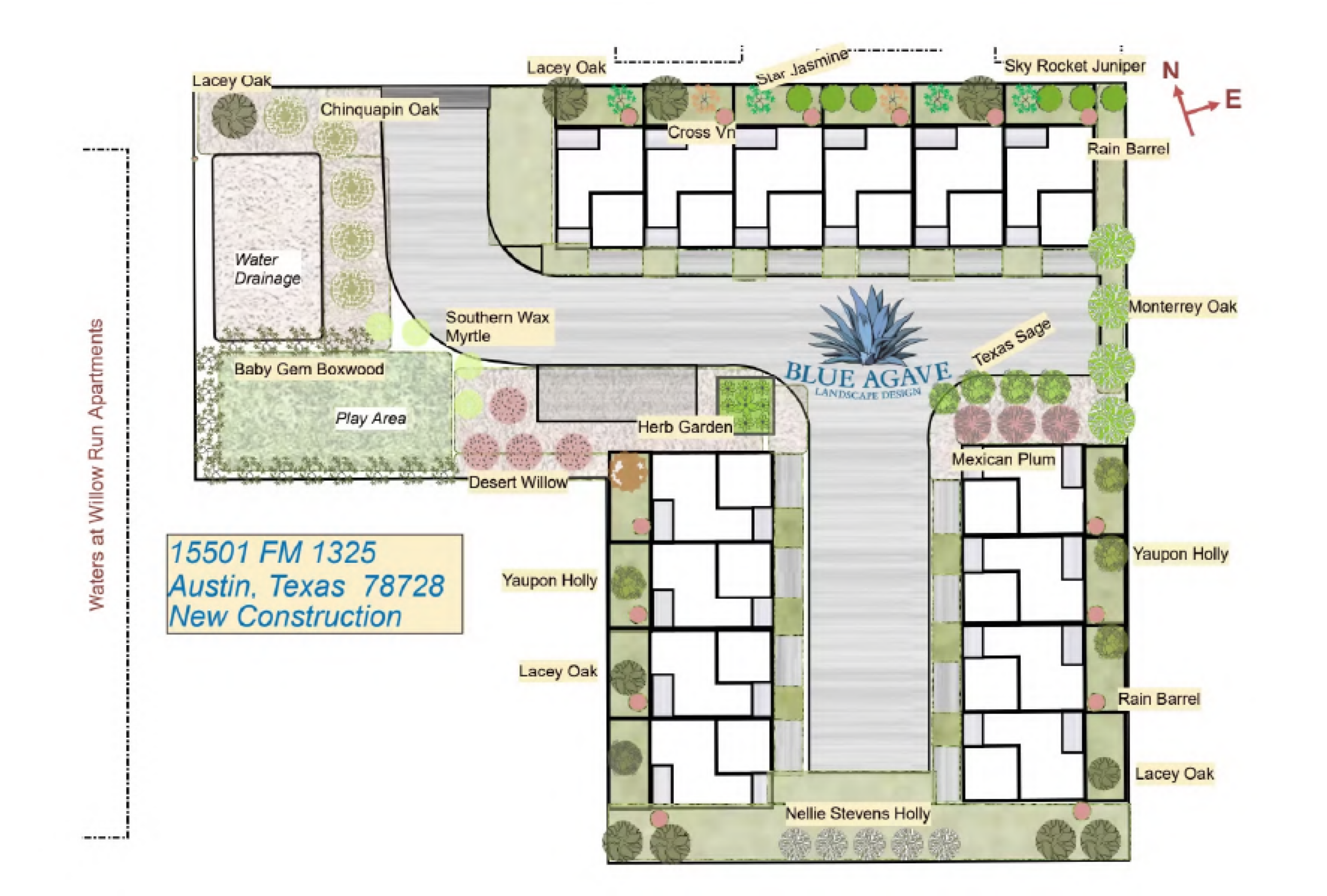

Prelim Site Layout

The Elm

Market Analysis

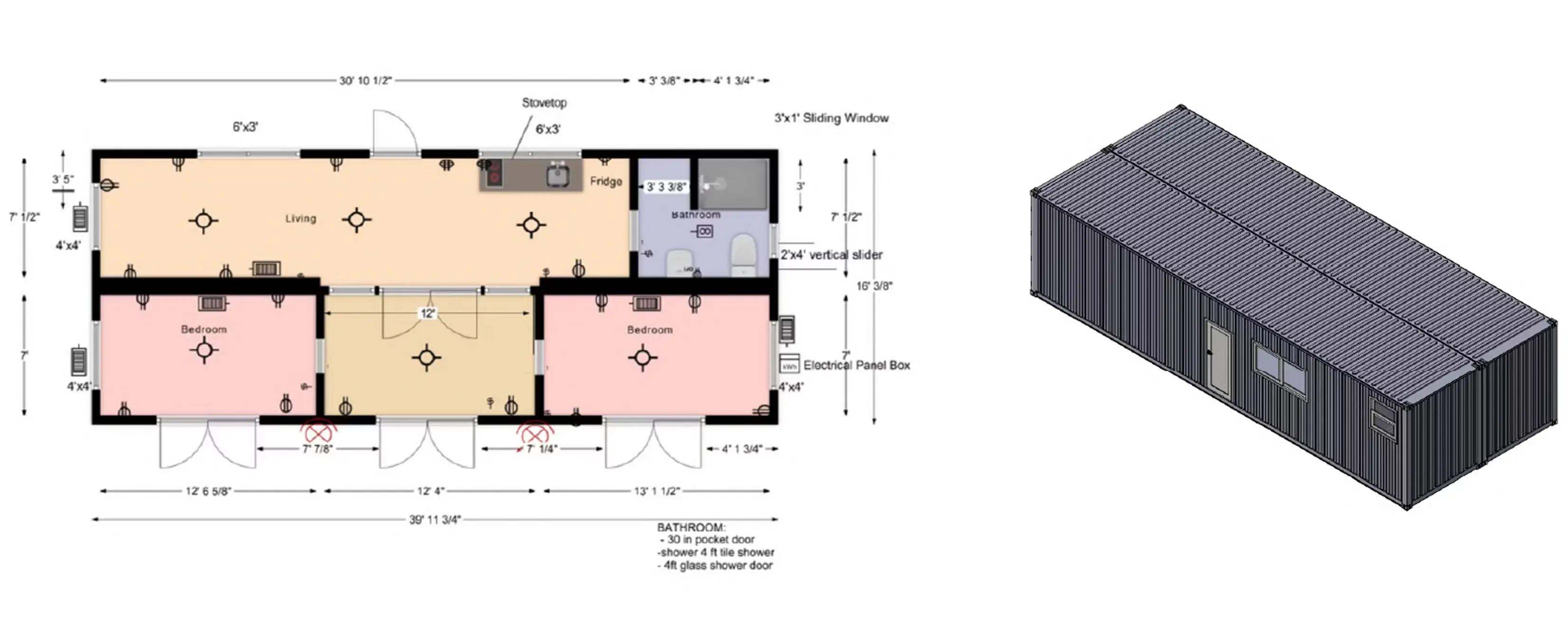

The container home community you're developing offers 20 units, each spanning 640 square feet with 2 bedrooms and 1 bath.

Positioned at a competitive rent of $1,800 the project targets a growing demand for affordable, modern living spaces. Average rents in the area range from $2,000 to $2,500, positioning our offering below market rates.

This pricing strategy aligns with regional rental trends and positions the community as an attractive option for renters seeking affordability without compromising quality

Projected Timeline

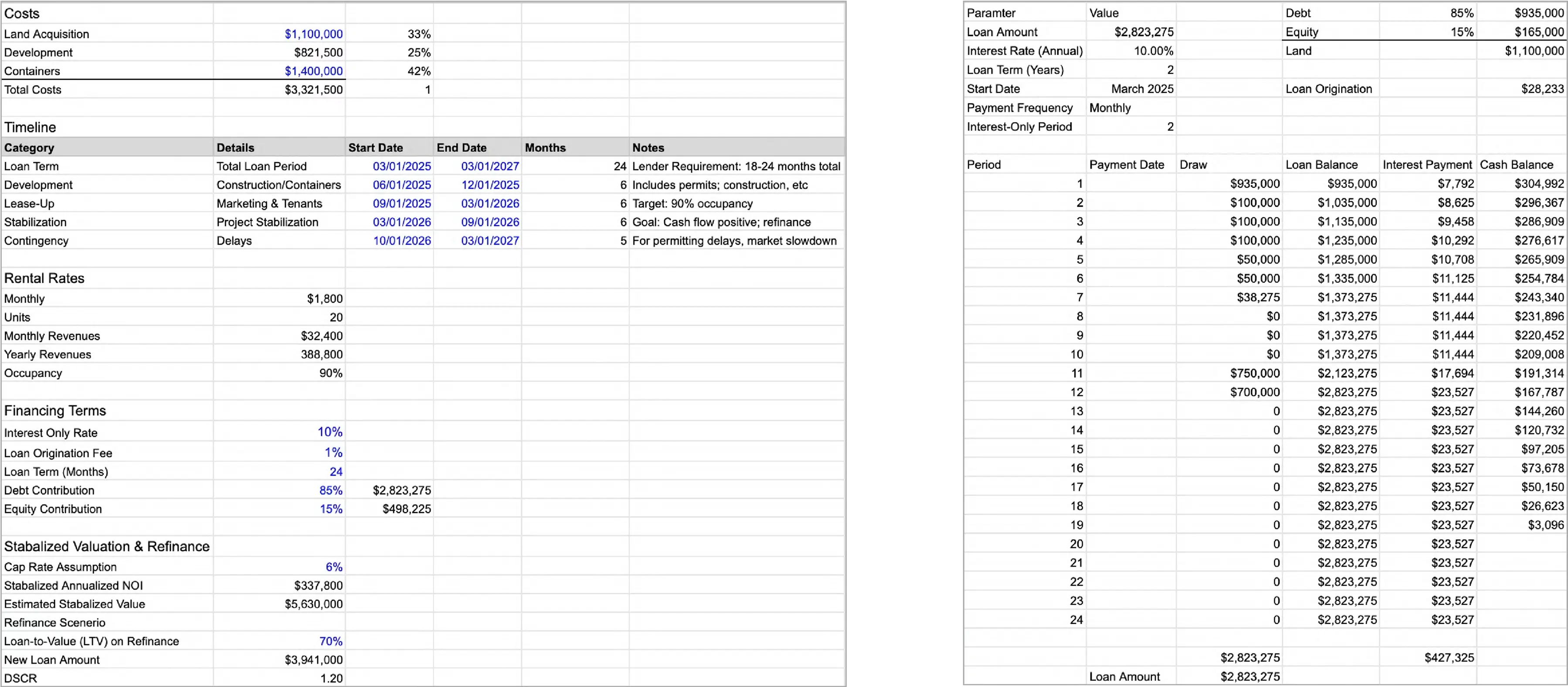

Assumptions and Debt Schedule

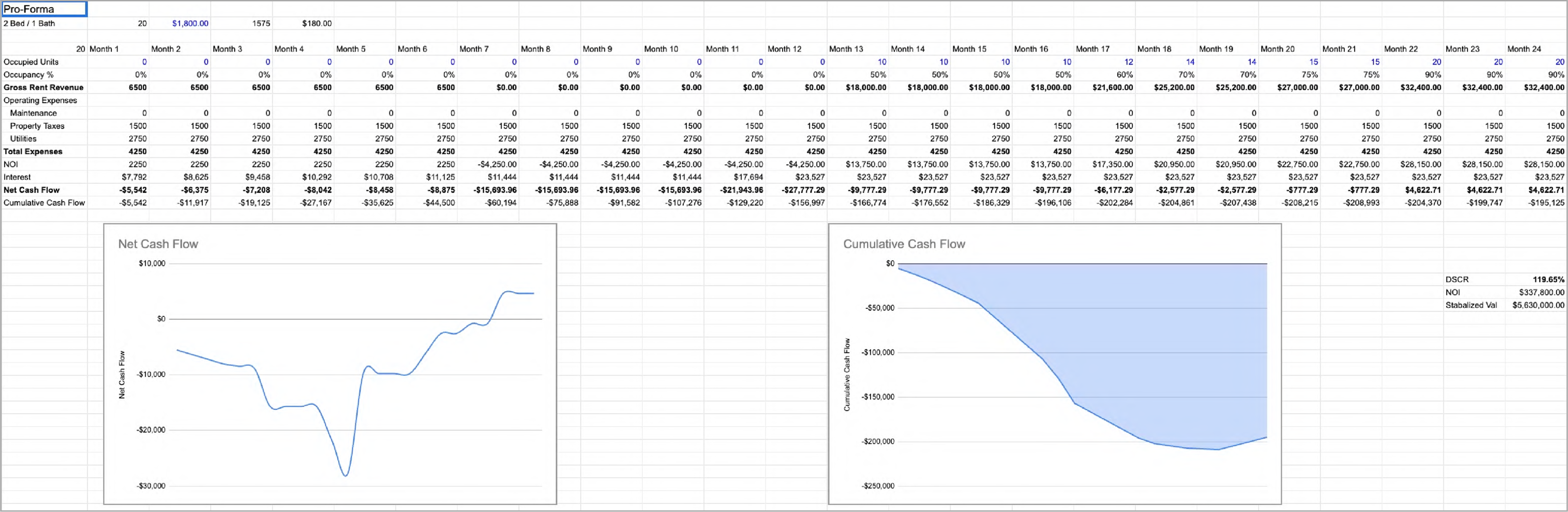

Cashflows

Sensitivity Analysis at 90% Occupancy

Investment Highlights

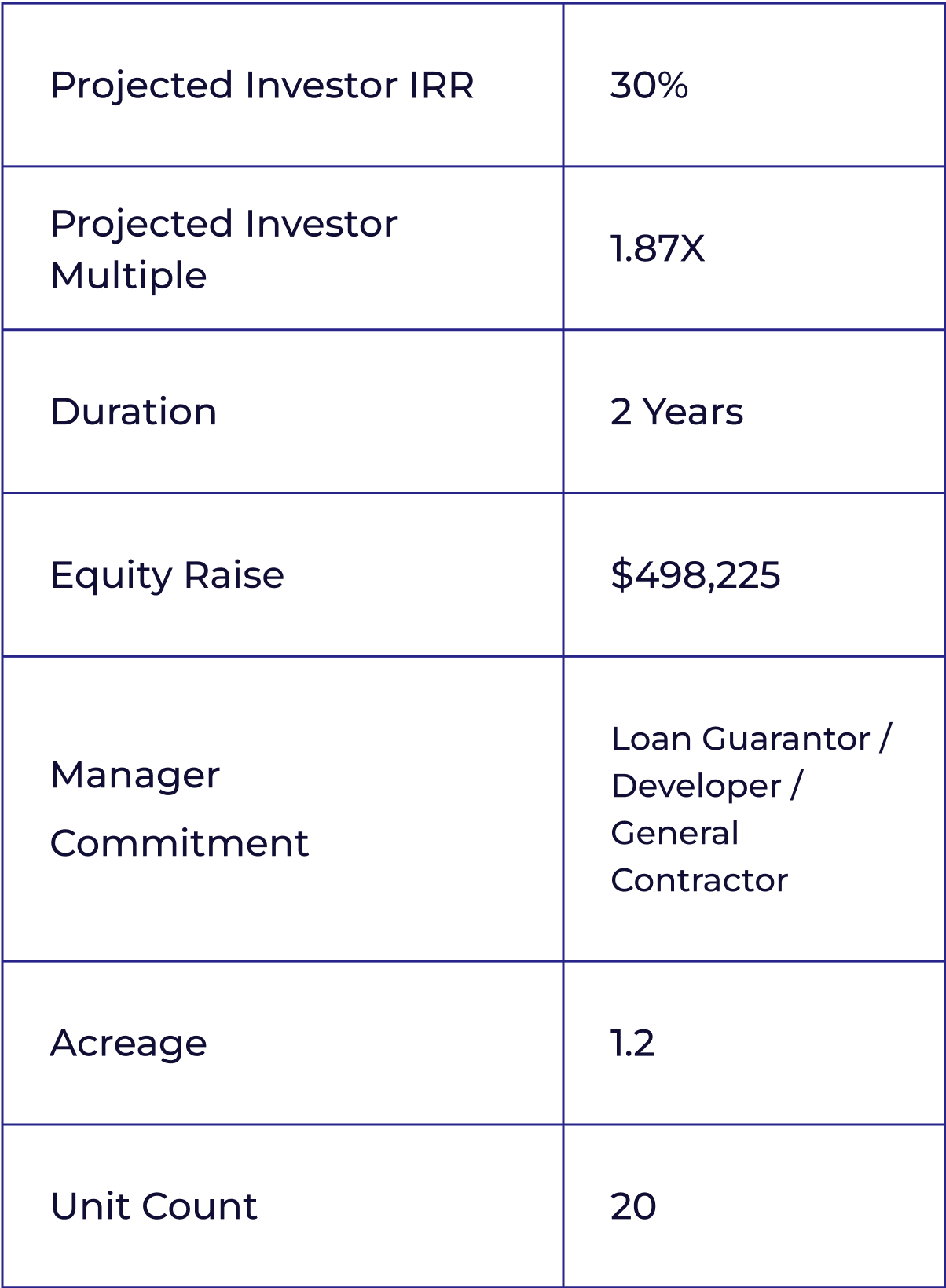

IRR: Projected 30%+ IRR for equity investors via refinance/sale

Low Equity Requirement: 15% equity ($498K) with 85% debt ($2.8M).

Advantage: Containers delivered in 4 months; no permits with City of Austin

Market Resilience: $1,800/month rent aligns with mid-tier housing demand.

Financial Snapshot

Capital Stack & Returns

Timeline & Milestones

Risk Mitigation

Pre-Leasing: Aggressive marketing to minimize vacancy risk.

Fixed Construction Costs: Bob’s Containers guarantees delivery timeline.

Conservative Cap Rate: 6% aligns with market comparables.

Sensitivity Analysis: current model at 90% occupancy

Use of Funds

Disclaimer

The information contained herein is provided to you on a confidential basis at your request for informational purposes only and may not be relied on in any manner as legal, tax or investment advice or an offer to sell or a solicitation of an offer to buy securities. A private offering of securities will only be made pursuant to a confidential private placement memorandum (the “PPM”), which will be furnished to qualified investors on a confidential basis at their request for their consideration in connection with such offering. No person has been authorized to make any statement concerning the securities offered other than as set forth in the PPM and any such statements, if made, may not be relied upon. An investment in private securities involves significant risks, including the potential loss of the entire investment. Before deciding to invest, prospective investors should pay particular attention to the risk factors contained in the PPM. Investors should also have the financial ability and willingness to accept the risk characteristics of an investment in the securities being offered thereby.