Independent Exploration & Direct Midstream

Cedar Hill Prospect

Two Commercial Saltwater Disposal Facilities

Midland County, TX / Reeves County, TX

Cedar Hill Prospect

2 Commercial Disposal Facilities

Midland County / Reeves County TX

Wells:

Unit Availability:

Reserves:

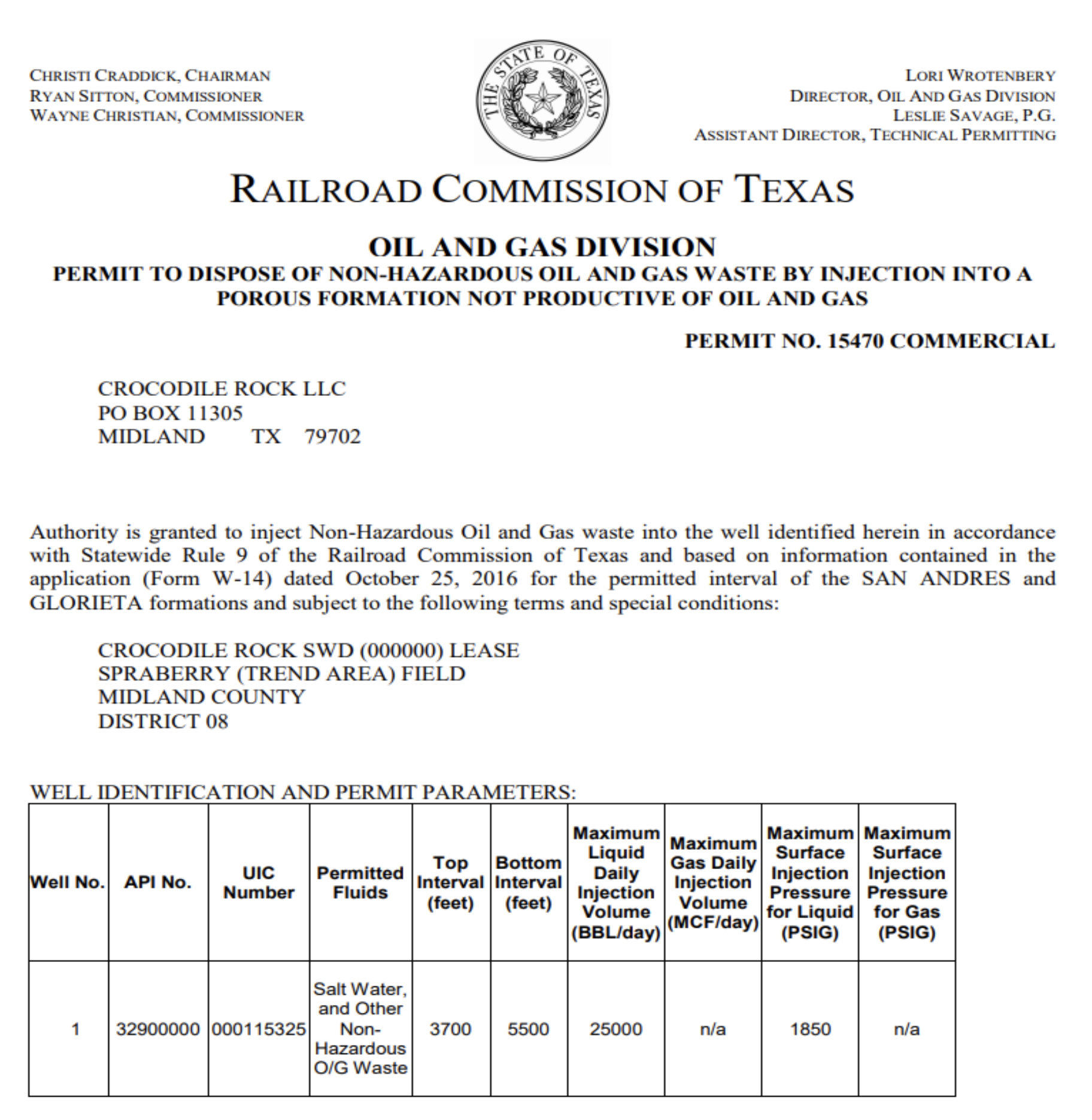

Crocodile Rock SWD Stanton, TX Midland County

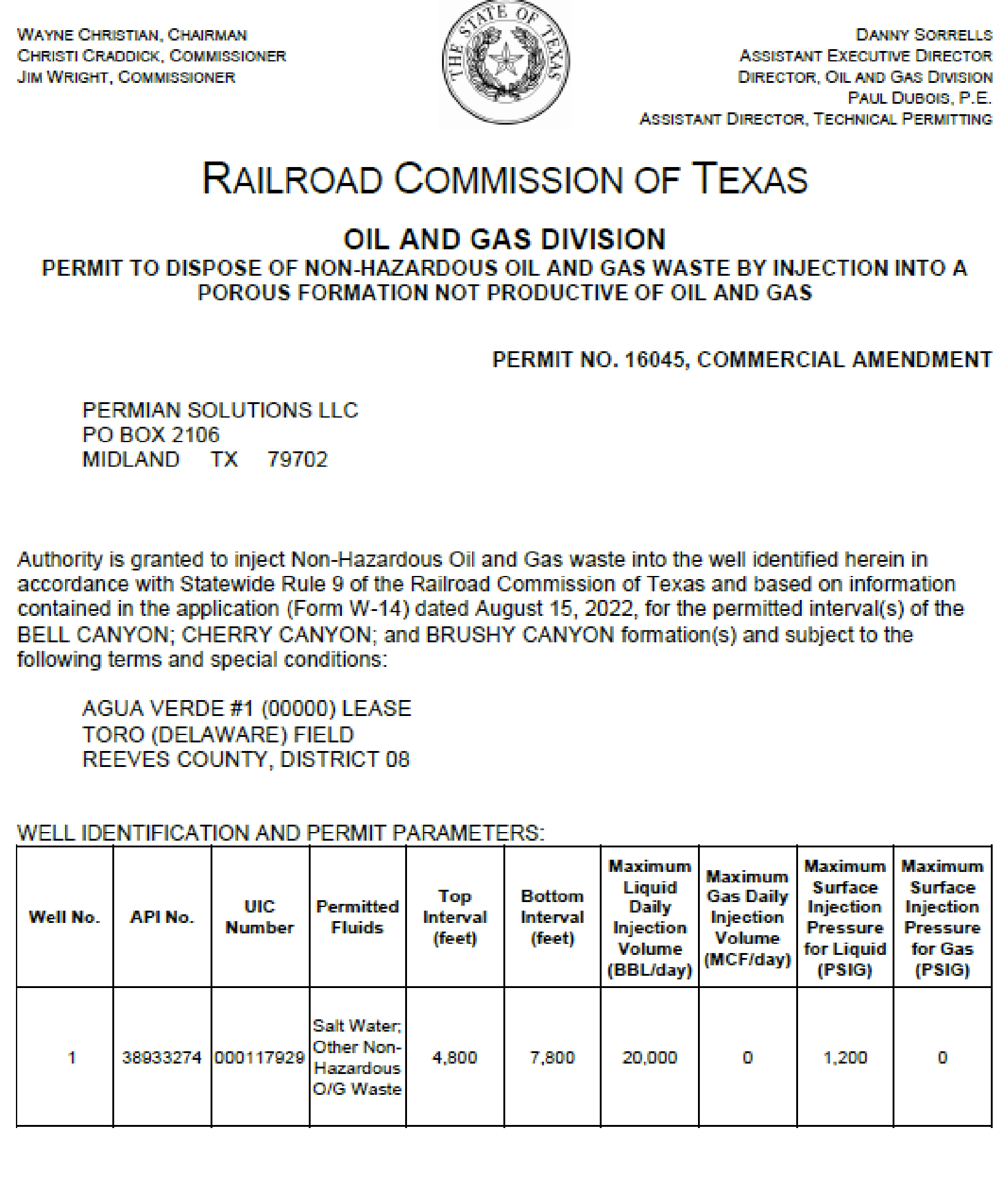

Agua Verde SWD Pecos, TX Reeves County

30 Units - $280,000 per Unit

2% Working Interest / 1.6% Net Revenue Interest in each Facility

Crocodile Rock Permitted to Inject 25,000 Barrels of Water per Day

Agua Verde Permitted to Inject 20,000 Barrels of Water per Day

Cedar Hill Prospect

2 Commercial Disposal Facilities

Midland County / Reeves County TX

Wells:

Crocodile Rock SWD Stanton, TX Midland County

Agua Verde SWD Pecos, TX Reeves County

Unit Availability:

30 Units - $280,000 per Unit

2% Working Interest / 1.6% Net Revenue Interest in each Facility

Reserves:

Crocodile Rock Permitted to Inject 25,000 Barrels of Water per Day

Agua Verde Permitted to Inject 20,000 Barrels of Water per Day

Project Details: We will be drilling and completing 2 brand new commercial saltwater disposal

wells in areas that we have determined could benefit from additional produced water management.

The permits that we acquired for the two wells are incredibly valuable due to the proximity of

these new facilities to existing and permitted production, major operator’s central gathering

facilities, and pipeline networks. In addition to this, these facilities will be built in areas that require

more injection capacity, as most properly run offset facilities are at or near full capacity, and a

significant number of new production wells are being permitted in the vicinity, which will continue

to benefit the disposal infrastructure. Due to local permitting restrictions, new SWD permits in

both Midland County and the Pecos area of Reeves County are difficult to obtain and highly

valuable.

Development Plan: We will drill and complete a new well-bore for each facility and build out a

state-of-the-art commercial saltwater disposal facility on each site. These sites, as proposed, will

each have:

o Four covered offload lanes for truck traffic and pipeline hook-ups that feed directly into

the system. These offload and tie-in points will each be gauged and monitored, and our

system will be fully automated to make billing much easier.

o A fully automated disposal system composed of 6 receiving tanks, 2 gun barrel tanks, 4

downhole tanks, and 3 oil tanks. This system will be able to be monitored both on-site

and remotely, reducing the risk of accidents, oil being wasted downhole, or not being

able to meet capacity requirements.

o An office at each location with bathrooms, showers, and a trucker lounge area with

snacks and refreshments. Building a strong relationship with local truckers is vital to our

business plan, and the added amenities and ease of use will allow us to be competitive.

o Freshwater and brine water sales can be added to the sites, allowing additional lines for

revenue. Agua Verde has acreage available for creating an 8-acre water pit that can hold

1.5 million barrels, and the landowner is interested in a joint venture that will allow us to

recycle water with them from our disposal and store it in the pit for eventual sale.

o Washout Pits will be installed upon the pit’s permit approval. This will allow us to tie in

another revenue stream of $500-$1000 per washout. Truckers are required to clean out

trucks and frack tanks at permitted facilities which can properly dispose of any fluids

used to clean them to prevent any environmental contamination.

What are Commercial Saltwater Disposal Facilities?

Commercial Saltwater Disposal Wells are Crucial Oilfield Infrastructure

The Permian Basin is one of the world’s most prolific and important oil fields and is responsible

for most of Texas’s oil production. While the wells drilled in West Texas can produce massive

amounts of oil, they also typically produce 4 to 5 barrels of water for every barrel of oil, creating

a huge market for infrastructure that can support the disposal of this produced water. According to B3 Insight, the Permian Basin produces over 22.5 million barrels of water per day, all of which are classified as industrial waste and require safe disposal by injection deep into the earth in a porous, non-productive zone that won’t interfere with the local groundwater.

This produced water is brought by truck or by water pipeline to either their own independently

owned water injection wells which are restricted to an operator’s personal use, or brought to

commercial saltwater disposal facilities that are open to the public.

What is in this “produced water”?

Produced water is typically mineralized brackish or brine water, and can contain heavy metals,

chemicals, radioactive isotopes, and, most importantly for us, oil. The presence of these salts,

metals, and other potential contaminants is why a safe way to dispose of this oilfield waste is so

vital to the continued success of the Permian Basin.

Who regulates produced Saltwater Disposal?

The Texas Railroad Commission strictly regulates this produced water to ensure its safe disposal

and is in charge of overseeing and regulating the management of this water. They issue commercial and non-commercial disposal solutions, ensure that proper safety protocols are followed, and keep track of where every drop of oil and water is produced, disposed of, and sold in the state of Texas.

The Texas Railroad Commission is in charge of making sure that there is a balance between the

water disposal needs of the producers, environmental safety standards, and the prevention of man- made seismic events.

What companies will be our customers?

Major oilfield operators and smaller independents alike will require the use of commercial

saltwater disposal wells and other midstream services that can be provided on-site. Direct

Midstream currently operates 10 commercial saltwater disposal facilities that have established

relationships with many of the major companies that will make up our clientele, including:

Chevron, Endeavor Energy Resources, Vital Energy, Exxon’s XTO / Pioneer Natural Resources

divisions, COG Operating, Crownquest, Occidental Permian, Permian Deep Rock, Diamondback

E & P, ConocoPhillips, OWL, Apache, and many others.

Revenue Streams for Commercial Saltwater Disposal Facilities

Commercial saltwater disposal facilities are able to create multiple streams of revenue in the

midstream sector. These can include:

Disposal of produced water and flowback water

Produced water, flowback water, and wastewater are brought to commercial

saltwater disposal facilities by truck and by pipeline. These facilities are set up with

gauges on the pipelines, and automated ticketing systems to bill the trucking

companies that bring water for disposal.

Disposal fees vary by contract and average between $0.35 and $0.75 per

barrel.

Skimming the oil that is in the produced water so it can be sold.

Produced water and flowback water typically have a significant amount of oil

dissolved in the water or that is sent in conjunction with the water. This oil can be

extracted from the water by mechanical separation techniques and chemical

processes and then sold for the regional spot price.

Produced water can have anywhere from .5% oil to 3% oil on average,

depending on how well the producer separates the water from the oil at their

tank battery.

Some flowback water and water pulled from the bottoms of oil tanks can

contain oil cut over 10%.

Freshwater and brine water sales on location.

Partnerships with the local landowners can be made to share revenue from

freshwater sales from local water wells at freshwater stations or from lined pits.

Freshwater is a huge asset in the Permian Basin and is needed for both

drilling and fracking. A Shale well in the Permian Basin often requires over

100,000 barrels of freshwater to drill and frack.

Freshwater sells for an average of $0.65 per barrel.

A 10 lb. brine is used to kill the pressure on wells so that they may be safely

worked on. Typically, when working on a high-pressure well, most

operators elect to have 1,000 lbs. of brine on location as a safety precaution.

Brine can sell for $2.00 - $3.50 per barrel.

Washout pits for cleaning out trucks and frack tanks

Trucks and frack tanks need to be frequently washed out due to the nature of the

materials they hold or haul. Washouts need to be performed in an environmentally

safe manner, requiring the water to be run off into a permitted pit, then disposed of

in the same manner as other produced water to prevent any contamination.

Washout facilities on location can charge between $350 - $1,000 depending

on the material being cleaned out and the time spent at the washout pit.

Prospect Highlights

Wastewater is a natural byproduct of oil and gas exploration. The Permian Basin produces

an estimated 4-5 barrels of water for every barrel of oil, and this water is considered

industrial waste and must be safely disposed of in saltwater disposal wells which inject the

water deep into the ground.

Produced water and flowback water typically have anywhere from .5% oil to 3% oil which

can be skimmed from the water and sold by the owners of the disposal well. Chemical and

mechanical separation techniques can maximize this recovery.

Multiple lines of business can be installed on a commercial SWD location, creating

additional revenue streams. These include freshwater sales, recycled water sales for oilfield use, brine water sales, and truck washout pits.

Direct Midstream is currently making a strong push to be a major player in the Permian

Basin, currently operating 10 commercial saltwater disposal facilities and actively seeking

to expand on that footprint.

These two facilities will be built in areas that have distinct needs for more water disposal

capacity and should be able to build a robust client base quickly.

These Facilities are to be built in the most prolific parts of the entire Permian Basin,

Midland County and Reeves County.

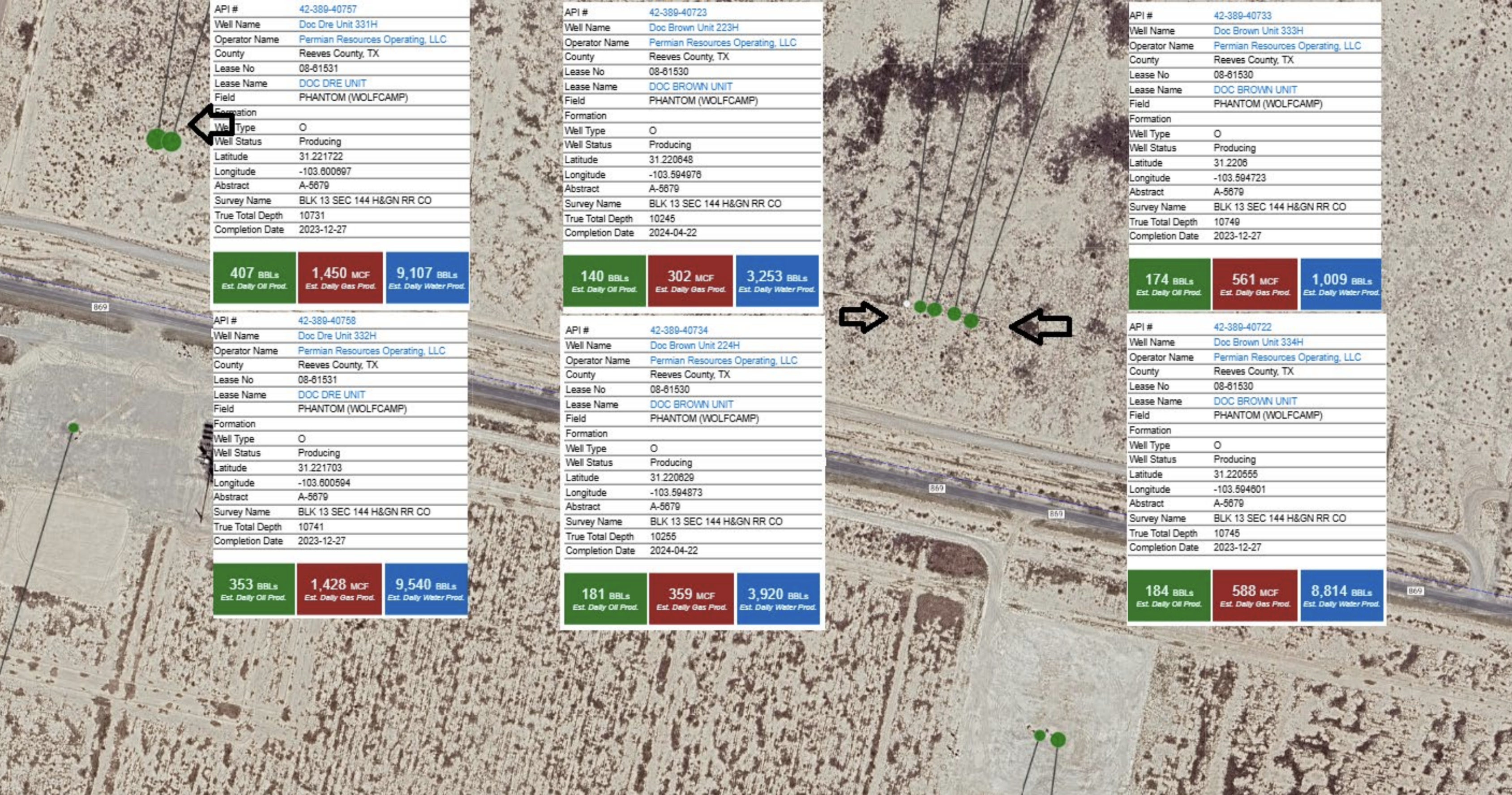

The Agua Verde SWD is 9 miles south of Pecos in Reeves County, TX. This is one

of the hottest areas in the Permian Basin currently, with Noble, Permian Resources,

COG, Vital, Apache and EOG aggressively drilling new wells in this area.

Reeves County is the #3 highest producing county in Texas for oil, with

13.3 million barrels produced in November 2024, and was also the #1

natural gas-producing county in Texas during the month of November 2024.

Most comparable commercial saltwater disposal wells in the area are at

capacity, seeing water volumes that come close to exceeding their daily

allowance. Local facilities have a track record of injecting between 400,000

and 800,000 barrels of water per month in this part of Reeves County.

We have access to up to 100 acres of land on the side of a major highway,

Rt 17, to develop not only a state-of-the-art disposal facility, but also to

build out any additional lines of business that can add to the overall cash

flow of the facility.

We have a deal with the landowner, who is in the water recycling business,

to recycle some of the water that we produce from Agua Verde and develop

an 8-acre pit capable of holding 1.5 million barrels of recycled water that

can be resold for fracking and drilling operations. This will not only deliver

additional revenue, but it will also increase our disposal capability beyond

the 20,000 barrels of water we are permitted to inject.

The Crocodile Rock SWD is 1.4 miles off I-20, a major interstate, between Midland

and Stanton in Midland County TX, right by the border of Martin County.

Midland County is the #2 producing county for oil in the state of Texas,

producing 18.5 million barrels of oil in November 2024. Martin County,

which borders Midland County near the future facility’s location, is the

number one county in the US for oil production, and made 18.7 million

barrels of oil in November 2024. Midland County and Martin County were

both in the top 4 for gas production in Texas.

Crocodile Rock SWD is in the heart of major established oil production,

and the local operators are actively planning additional local drilling.

Pioneer has a major gathering facility directly next to the proposed facility

and has about 7 pipelines running on the surface across the lease. These

could be tied to our system and will give a strong baseline for water

deliveries.

Lario has a tentative deal to set up a pipeline to this facility which was in

place with the landowner and that deal can be revived once the well is

drilled.

Offset commercial saltwater disposal facilities are not premium facilities,

yet many have average monthly disposal volumes from 100,000 – 600,000

barrels of water per month.

Facility Design

Prospect Economics

1 Unit = $280,000

2% Working Interest / 1.6% Net Revenue Interest in each facility

Anticipated Operating Expenses

The upfront costs of sensors, kill switches, automated ticketing, and other automation for the

facilities, along with our existing field staff, roustabout crews, billing department, and marketing

department, will help keep the facilities functioning properly, maintenance costs down, and keep

overall monthly operating costs down. The facilities will require monthly expenditure on routine

maintenance, chemicals to maximize oil extraction and prevent scale buildup, 24-hour attendants,

specialized software, snacks and refreshments in the lounge, billing, ticket validation, internet, and

electricity. These expenses will be deducted from the quarterly revenue. Advanced security and

camera systems, and local management of over a dozen facilities will allow attendants to “float”

between facilities if needed, respond quickly to any emergencies, and divide overall “back of

house” costs such as accounts receivable between other facilities, reducing overhead.

Anticipated Revenue

Revenue will be a combination of all cash flow derived from the facility, including disposal

revenue, skim oil sales revenue, water sales, and

Average water disposal price:

Average water sales price:

Average brine water sales:

Average washout price:

$0.50 per barrel trucked, estimated $0.75 via pipeline

$0.65 per barrel

$2.50 – $3.50 per barrel

$500 - $1,000 (based on time used and truck contents)

The facilities’ systems will be designed with attention to maximizing oil skim from the water, so

we will be plumbing in enough tanks to handle the disposal of large volumes of water while still

having enough space to mechanically separate the skim oil that moves through the system. Some

facilities will sacrifice the skim oil to focus on moving high volumes of water; however, with some

additional upfront capital spent on advanced tank automation, storage tank volume, additional

attention to detail by staff, and a good chemical program we should be able to maximize oil

extraction while maintaining high disposal volume. We plan to target a balance of pipeline water

with .5% - 1% oil cut, trucked water which typically contains 1%-3% oil, trucked flowback water

containing over 10% oil, and trucked water from oil tank bottoms which can contain over 10% oil.

We estimate that the combined monthly intake of both facilities should exceed half capacity,

675,000 barrels of water (22,500 barrels of water per day), and deliver over .5% oil cut. This should

be a reasonable expectation when considering locally produced water volumes and other SWDs.

Estimated Revenue at 50% Capacity:

675,000 barrels of water at $ 0.50

3,375 barrels of oil, over .5% oil cut, at $70 per barrel

Monthly revenue after deducting operating costs

Annual net revenue

$337,500

$236,250

$513,750

$6,165,000

per month

per month

per month

annually

Annual revenue per unit

$98,640

35% annually

Well Review

Crocodile Rock SWD #1

Crocodile Rock SWD is located between Midland, TX and Stanton, TX, strategically permitted to

be drilled 1.4 miles from Interstate 20 on County Rd 1040, a main road in the area that supports a

significant amount of oilfield traffic. This location is especially exciting because it is in the heart

of a very prolific field, and the local SWD facilities appear to be close to full capacity. Pioneer

Natural Resources has 3 drilling pads that feed into the gathering facility directly adjacent to the

10-acre Crocodile Rock lease that produces over 6,000 barrels of water per day by itself. Exxon’s

XTO/Pioneer division has already reached out and discussed tying the Crocodile Rock SWD into

their pipeline system which spans over 1,162 miles of piped water and would immediately give

Crocodile Rock SWD a significant volume of water the moment the facility is inspected and

approved for disposal by Exxon’s Environmental Compliance Department and the pipeline is tied

in. Lario Oil and Gas Company also is interested in tying a pipeline into the SWD and even had a

lucrative deal in place with the prior lessee that can be revived once the facility is built.

Offset Operators and SWDs

Crocodile Rock SWD is in a prolific area for oil and gas production. Local Operators within 5 miles of the facility include Pioneer Natural Resources, Diamondback E & P, BTA Oil Producers, Scout Energy Management, Lario Oil and Gas Company, Midland Energy, Petroplex Energy, MWJ Producing Company, Ovintiv USA, and Oxyrock Operating.

Nearby commercial saltwater disposal facilities appear to be mainly focused on servicing pipeline water, and by targeting both piped water and trucked water we can ensure that we get both consistent deliveries via pipeline, and the trucked deliveries, which typically have higher oil cut. The main competition locally appear to lack state-of-the-art facilities, and by inserting a fully automated facility with a 24-hour attendant, a covered awning over the offload bays, an office with a truckers lounge, four offload lanes to cut wait times, and a truck washout we believe that we can not only compete with the local disposals, but also be the preferred disposal facility in the area.

Local Competition:

Deep Blue Central – Pronghorn SWD #42-317-43132

This SWD is very basic and appears to be focused solely on servicing pipeline water, not even having infrastructure for skimming oil from the water. Pronghorn is downstream from our location along the Pioneer Natural Resources Pipeline, where they seem to get a large share of their water.

The most recent months’ reported injection volumes show:

August 2024:

September 2024:

October 2024:

414,338 barrels of water

490,332 barrels of water

387,940 barrels of water

Ruger Properties - Rusty SWD #42-317-37469

This facility is also very basic; however, this one does have an uncovered offload lane for trucked water. This facility does not have any other infrastructure to attract truckers beyond an offload lane, leaving us in a strong position to corner the local market. This facility appears to be focused more on water disposal volume over skimming the oil from the water with the way its system is built, yet still sold 14,265 barrels of oil from 9/2023 - 8/2024, equivalent to $998,550 at $70 per barrel.

The most recent months’ reported injection volumes show: (data is missing for 9/24 and 10/24)

August 2024:

September 2024:

October 2024:

549,510 barrels of water

401,485 barrels of water

440,028 barrels of water

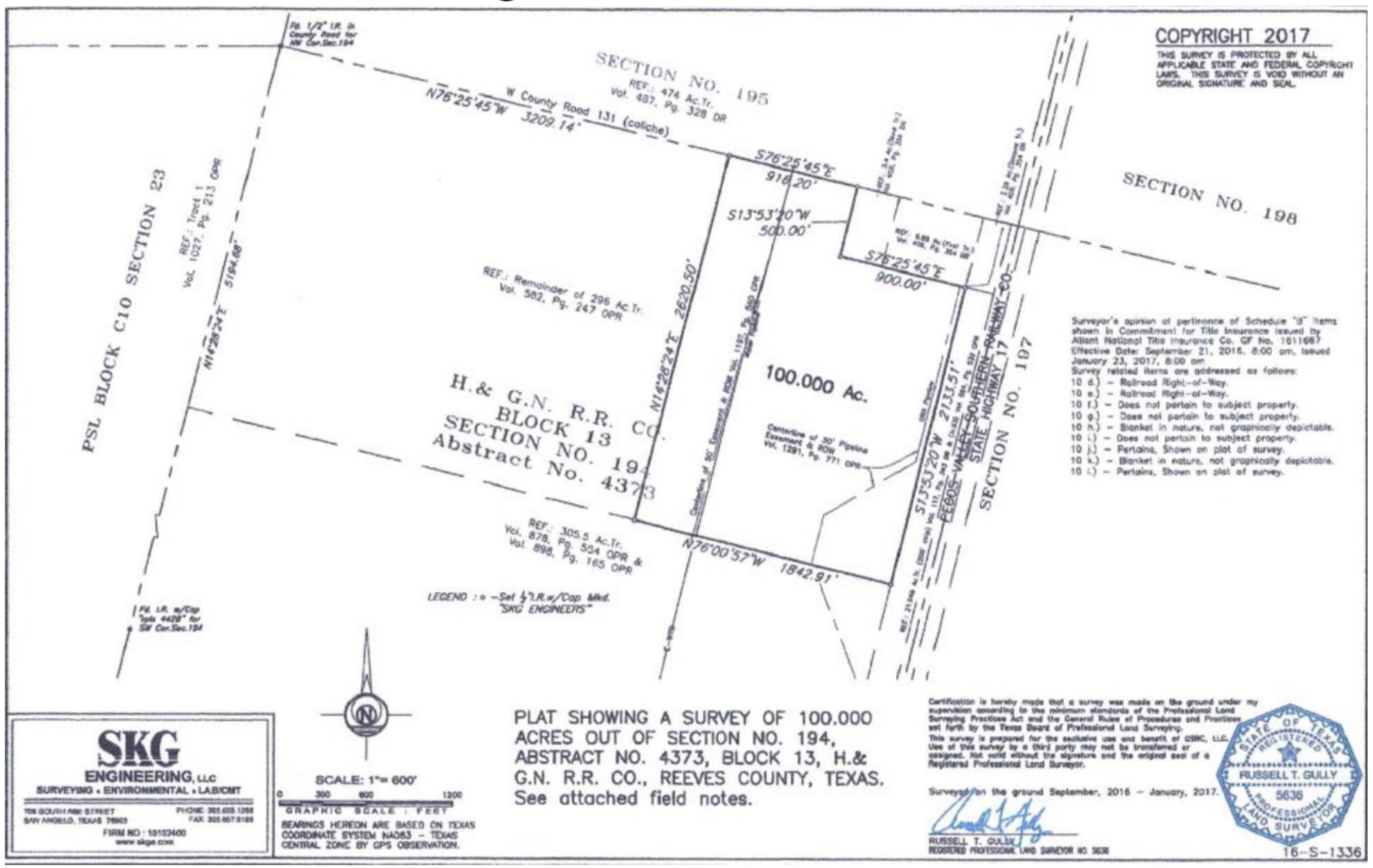

Crocodile Rock SWD #1

Survey and Permit Information

Well Review

Agua Verde SWD #1

Agua Verde SWD #1 is located 9 miles south of Pecos in Reeves County TX. This is a prime location for a saltwater disposal well, with plenty of offset wells with high water production and all comparable nearby commercial disposal facilities at or over full capacity, receiving between 400,000 and 800,000 barrels of water per well. The landowners are in the water recycling business and have made 20 acres of Rt 17 frontage available to us, with access to an additional 80 acres if needed to maximize profits. We have a deal in place to partner with the landowner on implementing water recycling on the property, which could recycle up to 15,000 barrels of water per day, increasing our facility’s disposal capacity and creating a new revenue stream selling recycled water to other companies from a proposed 8 acre, 1.5 million barrel lined water pit.

Offset Operators and SWDs

Reeves County is one of the most productive parts of Texas, ranking #3 in the state in oil production with large oil and gas operators such as Upcurve Energy, Noble Energy, Permian Resources, Greenlake Energy, Vital Energy, Apache, EOG Resources, and COG Operating locally. There are major pipeline systems in the area run by Waterbridge with 828 miles of pipeline, Centennial Resources with 253 miles of pipeline, Noble Energy with 156 miles of pipeline and Layne Water with 164 miles of pipeline. This is one of the most active parts of the Permian Basin, and operators are constantly permitting and drilling new wells in the Pecos area. A contract to receive water by pipe from just one nearby pad site could have us at full capacity, as there are several wells within a mile that make over 9,000 barrels of water per day.

Waterbridge - Orb SWD #1 #42-

September 2024:

October 2024:

November 2024:

609,576 barrels of water

529,124 barrels of water and 178 barrels of oils sold

508,693 barrels of water and 1,456 barrels of oil sold

Waterbridge - Scat Daddy SWD #1

August 2024:

September 2024:

October 2024:

641,510 barrels of water and 1,103 barrels of oil sold

644,880 barrels of water and 1,196 barrels of oil sold

737,944

Layne SWD – South Farm SWD

(April 2024 is the last month with reporting available, 2023 totals are mistakenly on the reports

for the remainder of 2024.)

February 2024:

March 2024:

April 2024:

567,207 barrels of water

331,373 barrels of water and 728 barrels of oil sold

607,477 barrels of water and 688 barrels of oil sold

CR Field Services – Golding SWD #1

August 2024:

September 2024:

December 2024:

562,012 barrels of water

518,429 barrels of water and 352 barrels of oil sold

494,183 barrels of water and 3,508 barrels of oil sold

Waterbridge – Cotton Gin SWD

September 2024:

October 2024:

November 2024:

314,862 barrels of water and 2,113 barrels of oil sold

397,640 barrels of water and 379 barrels of oil sold

343,845 barrels of water and 163 barrels of oil sold

Survey and Permits

Agua Verde SWD #1

Tax Advantages of Oil and Gas Investing

As a general partner participant, each partner benefits from the tax deductions available for oil and gas drilling including intangible drilling costs, depreciation, operating costs, and percentage depletion. Structured properly, partners may offset their taxable income gained from other sources with the substantial deductions available from investing in oil/gas wells.

Intangible Drilling Costs

Intangible Drilling Costs (IDCs) are drilling expenditures related to expenses such as labor, chemical, hauling, etc. IDCs usually represent 70% of the cost of a well and are eligible for the election to be deducted 100% against taxable income in the first year. For example, investing $100,000 in a project that had 70% of its costs in IDCs would mean the investor can deduct $70,000 from their taxable income for that year. In a top 39.6% federal tax bracket for individuals, that deduction would save approximately $27,720 in federal income taxes for that tax year. To encourage expenditures for oil and gas drilling, IRS code section 461 has a special provision that allows IDCs paid before 12/31 of any given tax year to still be deducted in the same tax year provided the drilling of the well commences before the close of the 90th day after the close of the taxable year and other certain conditions are met as per the regulations.

Tangible Drilling Costs

The costs of oil and gas drilling equipment such as pumps, tanks, field offices, and wellheads are Tangible Drilling Costs (TDCs). Continuing with the example above, the remaining $30,000 (30% of the facility's cost) would be TDCs. These costs are capitalized and depreciated over a seven-year period.

Who We Are

Direct Midstream specializes in comprehensive fluid management solutions, offering full-cycle services for the energy industry. Our Water Services Division manages the complete process, from sourcing and gathering to the treatment, recycling, and disposal of produced water. In our CrudeOil Services Division, we ensure the environmentally compliant handling, processing, and recycling of crude products at our certified reclamation facilities. We expertly manage the entire lifecycle of waste streams associated with hydrocarbon production and extraction. Through our strategic partnerships, Direct Midstream provides flexible logistics solutions. Direct Midstream stands out due to our extensive experience and proven track record of success.

Direct Midstream Services Include:

Saltwater Disposal & Fluids Management

Crude Oil & Skim Oil Purchasing

Processing of Slop Oil, Tank Bottoms, Off-Spec Crude, and Condensates

Brine & Freshwater Solutions

Vacuum Trailer & Frac Tank Washouts

At Direct Midstream, we are committed to delivering reliable, cost-effective, and environmentally responsible fluid management solutions. Our dedication to innovation, operational efficiency, and industry expertise ensures that we consistently deliver high-quality services tailored to the evolving needs of our customers. As a trusted partner in the energy sector, we remain committed to fostering long-term relationships and driving sustainable success for our customers and the communities they serve.

Our Founders

Chris Early, President

Chris Early is a fourth-generation oil and gas professional with deep family roots in the industry. His grandfathers and father have had numerous successful oilfield ventures in the Texas and Oklahoma Panhandle, as well as internationally. With over three decades of executive and field experience, Chris has served as President and Vice President of multiple oilfield companies, specializing in produced water management, saltwater disposal, and pipeline operations. These companies were successfully sold for a total of $380 million. Mr. Early possesses extensive knowledge of production, completion, trucking, site design, and construction. He has also cultivated lasting relationships with many exploration and production companies nationwide.

Bryan Benson, CEO

Bryan Benson is a seasoned entrepreneur with over 11 years of experience in the oil and gas sector, recognized for his ability to identify & capitalize on market opportunities. His strategic vision has driven the successful acquisition of more than 9,000 acres of leases across Oklahoma and Texas, solidifying his presence in the industry. In addition to leading Independent Exploration, he owns and operates multiple companies across Oklahoma & Texas, including a construction firm and an oilfield services company. His extensive portfolio includes them management of 44 oil wells in Oklahoma, as well as 12 saltwater disposal facilities, with ongoing plans for expansion. His commitment to operational excellence and sustainable resource management continues to shape his impact within the energy sector.

© Magnolaia Ridge Capital LLC - All Rights Reserve 2023